If market situations change and similar vans are selling for only $3,000 after a decade, the estimated salvage value might have been too high. By leveraging these applied sciences, corporations can streamline asset valuation processes, improve salvage value depreciation formula accuracy, and make data-driven decisions via modules designed for various aspects of asset management. This enhances total asset administration, making certain that resource allocation aligns with strategic objectives and promotes long-term monetary sustainability. Moreover, many software platforms provide e mail assist as part of their customer support, guaranteeing users can maximize the tools’ potential. For instance, understanding the salvage worth helps decide the optimum level to promote or retire an asset before its operational costs outweigh its advantages. Moreover, it aids in evaluating the monetary viability of upgrading gear or investing in new expertise.

Accountants use a number of strategies to depreciate property, including the straight-line foundation, declining steadiness technique, and items of manufacturing method. Each methodology makes use of a special calculation to assign a dollar value to an asset’s depreciation throughout an accounting yr. The formulation to calculate the annual depreciation is the remaining guide https://www.kelleysbookkeeping.com/ worth of the mounted asset recorded on the steadiness sheet divided by the helpful life assumption. The double declining method (DDB) is a form of accelerated depreciation, where a higher proportion of the total depreciation expense is acknowledged in the preliminary stages.

Company

This decrease is systematically recorded via depreciation, which allocates the price of an asset over its helpful life. Accrued depreciation is the whole quantity of depreciation expense that has been recorded for an asset since its buy, providing a cumulative account of the asset’s devaluation. This methodology requires an estimate for the entire models an asset will produce over its helpful life. Depreciation expense is then calculated per yr based on the variety of items produced.

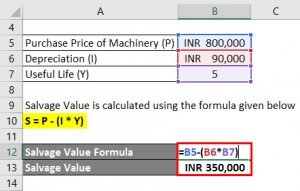

The total quantity of depreciation taken over the whole lifetime of the asset should equal the depreciable cost (cost minus salvage value). You can manually modify the depreciation expense taken to equal the depreciable cost, or you possibly can include further formulation to ensure that the entire depreciation equals the depreciable cost. If you are interested, these further formulas are included in the Excel workbook and produce the results proven within the screenshot below.

She holds a Bachelor of Science in Finance diploma from Bridgewater State University and helps develop content material methods. In Accordance to the straight-line method of depreciation, your wooden chipper will depreciate by $2,400 every year. Subsequent, you’ll estimate the worth of the salvage worth by contemplating how much the product will be worth on the end of its helpful life span.

Understanding The Distinction Between Amortization And Depreciation

Depreciation is recorded in the revenue statement, while the value of the asset is recorded on the corporate’s stability sheet. The salvage value of an asset like cars and computers refers to the final promoting value of the asset after many years. It typically refers again to the selling worth of the asset after its useful life is over. You can calculate this by an estimation methodology or by utilizing the depreciation technique.

- Study how to calculate the after-tax salvage value of business property, an important think about monetary decision-making and correct financial reporting.

- An asset for a enterprise cost $1,750,000, could have a life of 10 years and the salvage value on the finish of 10 years shall be $10,000.

- Understanding these variations helps businesses plan higher for asset disposal and financial reporting.

Depreciation Technique

These calculations help manage budgets, streamline replacements, and plan for future investments. Elements influencing a machine’s salvage worth embrace expertise modifications, put on and tear, upkeep practices, and market demand for used tools. This methodology supplies an correct reflection of asset usage, making it extremely beneficial for manufacturing industries. By intently aligning costs with productivity, companies can maintain monetary precision and equity in reporting. As the e-book value decreases annually, the expense calculation adjustments, tapering because it approaches the salvage worth. This technique is right for belongings that lose worth quickly, offering tax benefits and more precisely reflecting the asset’s market value in its early years.

On the revenue statement, it impacts depreciation expense, which impacts internet revenue. On the money flow assertion, it impacts capital expenditure and tax calculations. The complete depreciation of an asset is calculated by subtracting its salvage value from its unique buy worth. A greater salvage worth means less depreciation expense annually, while a lower or zero salvage value means the asset depreciates extra. Different depreciation methods treat salvage worth in a special way, which affects financial reporting. Salvage worth performs a pivotal position in financial reporting because it immediately impacts the depreciation expense recorded on monetary statements.